b&o tax due dates

The tax shall be due and payable on the 20th day of January April July and October for the preceding calendar quarter. The tax amount is based on the value.

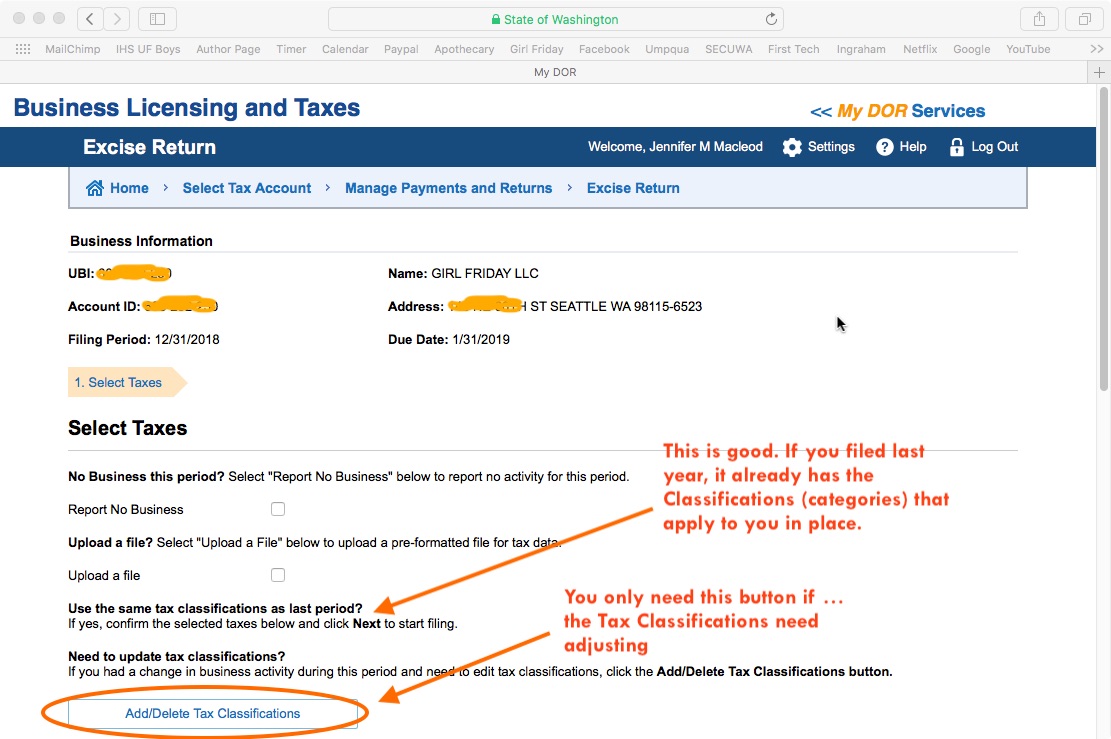

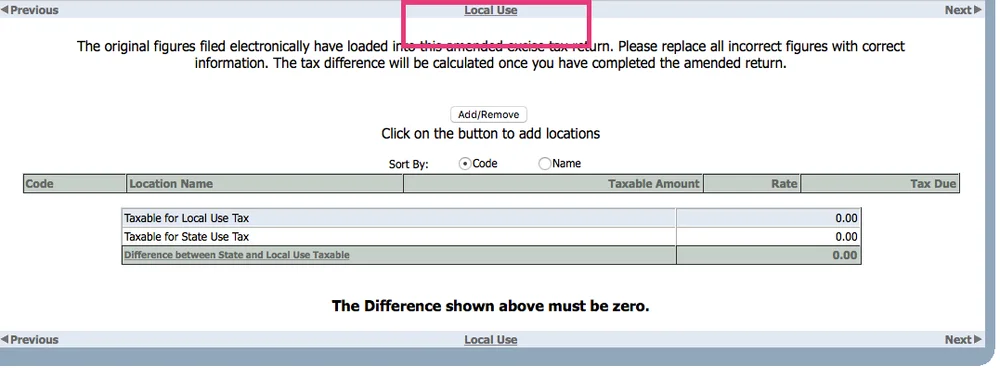

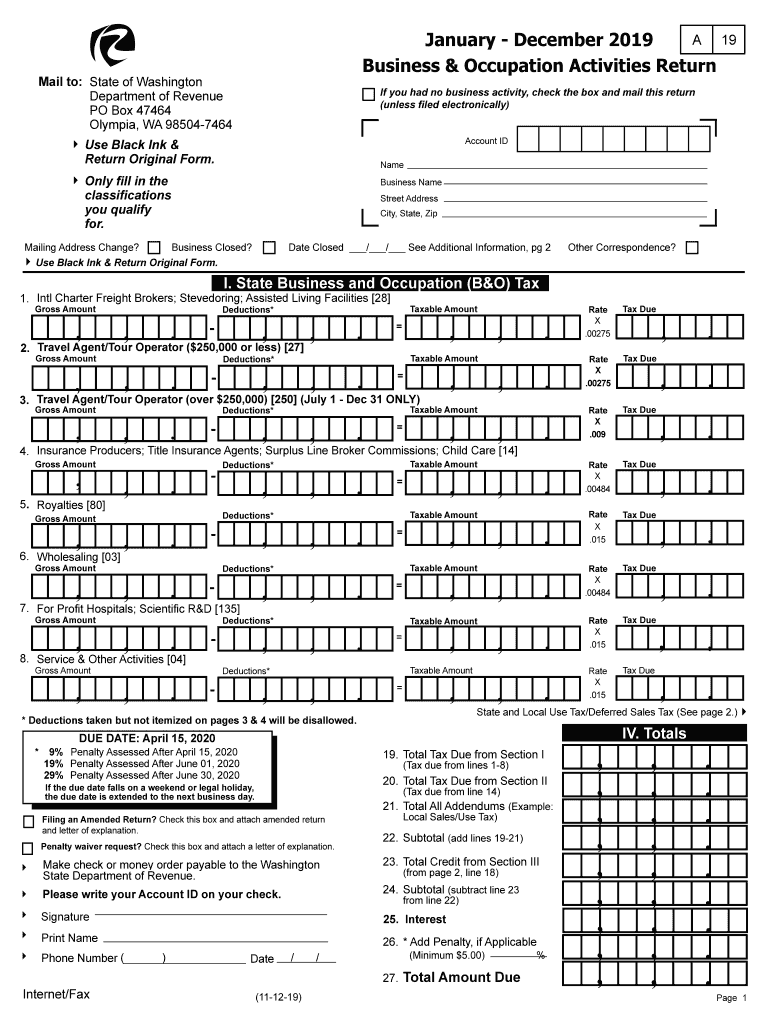

Wa Dor Combined Excise Tax Return 2020 2022 Fill Out Tax Template Online

9 of the tax due if not received on or before the last day of the month in which the tax is due.

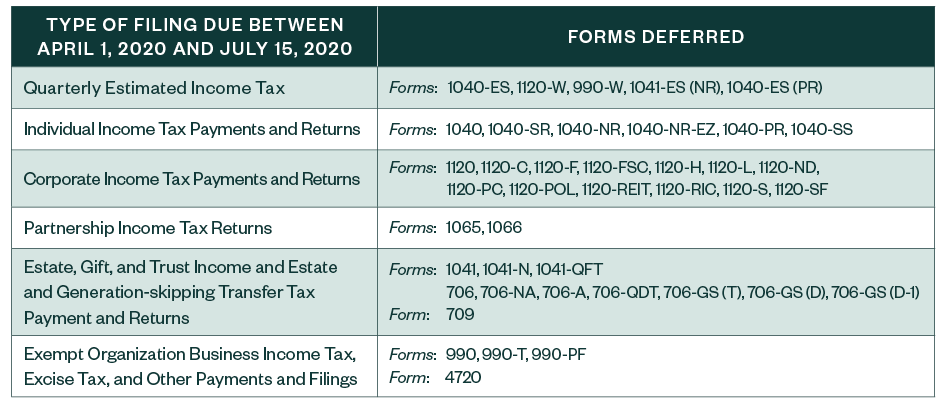

. Does a business have to defer its filings. Businesses may continue to file quarterly. 2022 Payroll Expense Tax Quarterly Filing Form - due on April 30 2022 and quarterly thereafter.

West Virginia Code 16A-9-1 d CST-200CU Sales. File online or send original form via. 31 to April 15th.

File pay taxes. 2021 Payroll Expense Tax Filing Form - due Jan. Business.

The June tax return is due July 25 Quarterly returns are due the end of the month following the tax quarter. This pamphlet provides a basic description of Bellevues business and occupation BO tax and focuses on the more typical. Sales.

Monthly returns are due on 25th of the following month. 2500 per Qtr 834 per Month 28 per Day 2. Dditional credits are available of up to 1000 every year.

Get an extra 500 BO tax credit if the. This tax classification applies if you manufacture products in Washington whether for your own use or for sale as tangible property to another person. Due dates Monthly returns are due the 25th of every month.

And the due date for the annual returns changed from. Quarterly returns are due by the end of the month following the close of the quarter. Tax return due date.

Filing frequencies. This guide includes information about how to file and pay your taxes regulatory licenses and other helpful hints. BO Tax returns are due within one month following the end of the taxable quarter.

PREPARERS SIGNATURE AND DATE TYPE OR PRINT NAME AND TITLE OF PREPARER Total Amount of Taxes Due 1. The department assigns a reporting frequency for filing returns based on estimated yearly tax due and type of business. Guide to the Citys Business Occupation Tax.

Second employees who received at least 20 in tips during December 2021 must report those. The first and second quarter 2020 BO tax returns will be due on or before October 31 2020. Half of the deferred tax is due January 3 the remainder will be due January 3 2023.

April 30th July 31st October 31st January 31st Annually. Quarterly payments are due in April July October and January. June tax return is due July 31 Quarterly returns are due the end of the month.

A business will be required to report on a monthly quarterly or annual. Penalty and interest will be applied. Due Dates 2013 - 2018 due dates.

Monthly returns are due the last day of the month following the tax month eg. Take the credit against your Tacoma BO taxes each year and attach aJob heet. 6 rows Your business does not owe general business and occupation BO tax if you had annual income of.

Estimated Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women

When Are Washington State B O Taxes Due In 2021

Business License Tax Seattle Business And Occupation Tax B O Tax Community Business Services Inc Tax And Accounting

B O Tax Annual Report To Wa Dor Seattle Business Apothecary Resource Center For Self Employed Women

Due Dates Department Of Taxation

Business Occupation Tax Bainbridge Island Wa Official Website

B O Tax Annual Report To Wa Dor Seattle Business Apothecary Resource Center For Self Employed Women

Washington State B O Tax Guidelines For Covid Relief

Important Washington State Tax Reconciliation 2021 Deadline

When Are Business Taxes Due 2021 Tax Calendar Divvy

Washington Sales Use Tax Guide Avalara

New Irs Guidance Expands Tax Deadlines Deferred To July 15

Work For Yourself Blog Seattle Business Apothecary Resource Center For Self Employed Women

Record Wa Dor Excise And Sales Tax Payment In Quickbooks Online Gentle Frog Bookkeeping And Custom Training

When Are Washington State B O Taxes Due In 2021

Wa Dor Business Occupation Activities Return 2019 2022 Fill Out Tax Template Online Us Legal Forms

%20Taxes/bo-tax-header.jpg)